In today’s letter, you are going to learn what “Paper Bitcoin” is, and, why its powerful to understand.

If you thought the 2008 mortgage crisis was the peak of financial alchemy, meet paper Bitcoin — the sleaziest trick in the 2025 playbook.

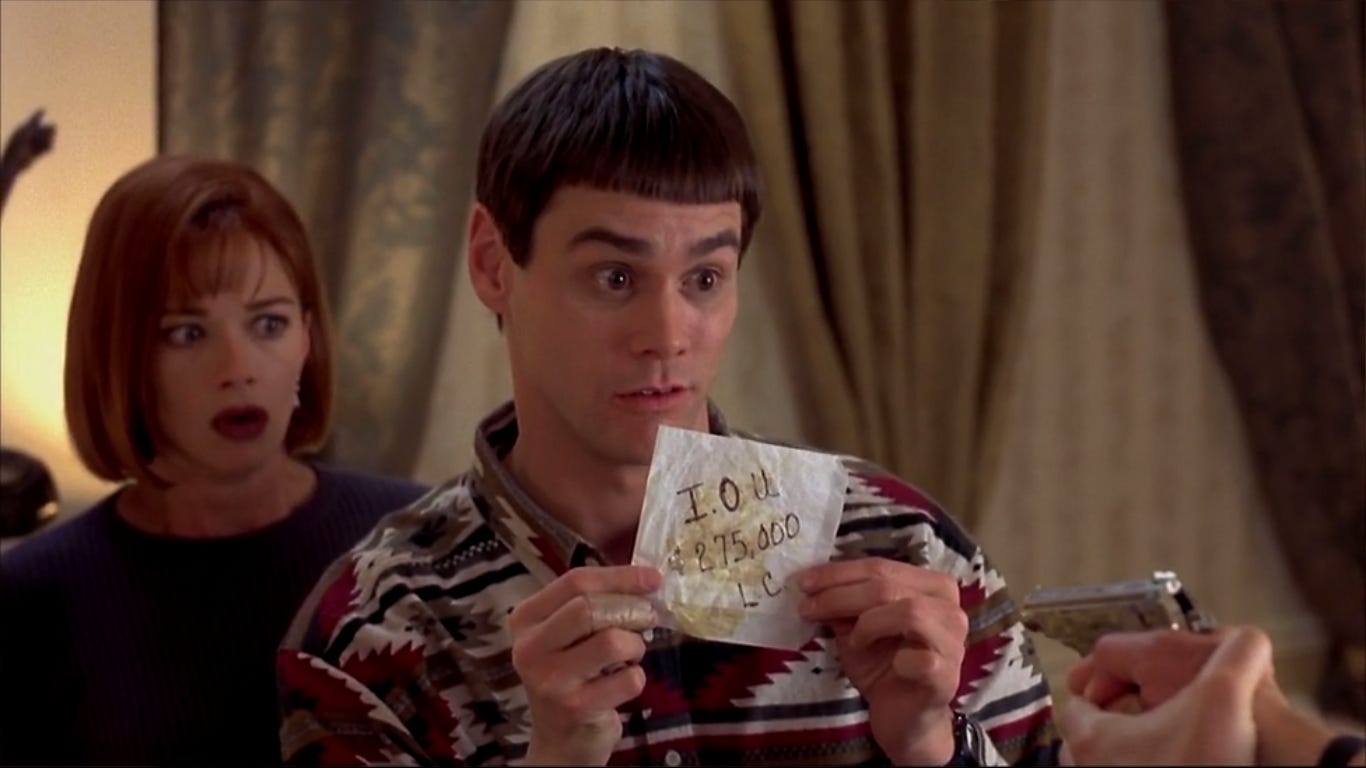

Paper Bitcoin isn’t real BTC. It’s a derivative claim — an ETF share, a futures contract, a perpetual swap, or an OTC “IOU” — that promises exposure to Bitcoin’s price without ever touching the actual network. Think of it as a casino chip that says “1 BTC” but is backed by nothing more than a custodian’s pinky swear. (fiat 2.0).

And the house? BlackRock, Fidelity, Coinbase, and the CME — the same crew that turned subprime debt into AAA-rated securities.

FORWARD

Read these previous letters before this one; otherwise you will just be walking around with pieces instead of the full picture:

[The Birth of Offline Bitcoin [2025] + [Withdraw from the System [2025] + [Simple Ways to Withdraw From the System [2025] + The Useful Idiots of Sauron [2025] + [$100k Bitcoin is Likely [2021] + [Bitcoin is Becoming the Global Reserve [2021]

Dumbing it Down:

Instrument: Spot Bitcoin ETFs.

What it is: Tradable stock shares “backed” by BTC in custody.

How it Manipulates: Authorized participants (APs) create unlimited shares via cash or rehypothecated BTC. Short-selling floods the market with synthetic supply to cap price. (what they’ve been doing with gold for 70+ years).

Instrument: Futures & Perps

What it is: Leveraged bets on future price (CME, Binance) - 95% of volume is on unregulated exchanges using wash trading and spoofing.

How it Manipulates: Institutions short futures, liquidate retail longs, then buy spot cheap.

Instrument: OTC Custodial IOUs -

What it is: Off-chain “Bitcoin” held by Coinbase/BlackRock

How it Manipulates: No on-chain proof. Custodians lend out your BTC to short-sellers, creating fractional reserves.

Result? $50B+ in ETF and corporate inflows in 2025… and Bitcoin still trades like a $95K meme coin.

Because most of that “demand” is just recycled paper.

The Real Goal:

Legitimizing the Stock Market Casino…The S&P 500 is a debt-fueled mirage — $6T in QE since 2008, $300T in global liabilities, and zombie companies surviving on 0% rates. (this is how Netflix appears to be revenue positive in the stock market when it hasn’t actually been net positive in revenue for years!)

Bitcoin ETFs are the perfect distraction:

“Crypto is mature now!” — screams CNBC as IBIT hits $40B AUM.

Pensions and 401(k)s allocate 1–5% to BTC, creating illusory diversification.

When BTC doesn’t moon despite inflows, it signals control — “See? Even Bitcoin obeys the Fed.” These are all so low IQ I cannot believe it ever worked once…and people are falling for it again lmao.

This is co-option, designed to deter adoption - but it will not work!

Here’s the Twist: Paper Bitcoin Proves Bitcoin’s Credibility

Yes — the very existence of this scam validates Bitcoin’s threat. Think about it:

They wouldn’t fake it if it wasn’t real.

Wall Street spent years lobbying the SEC to approve Bitcoin ETFs. Why? Because they can’t ignore $2T in market cap. Paper Bitcoin is their attempt to contain the revolution, not dismiss it.Every IOU needs a real asset underneath.

You can print unlimited ETF shares… but someone has to deliver the BTC when redemptions hit. BlackRock’s 500,000+ BTC holdings? That’s real coins, quietly accumulated during price suppression.The more paper, the louder the signal.

When 95% of volume is fake, on-chain data becomes the ultimate truth serum. Tools like Glassnode, Arkham, and proof-of-reserves audits expose the fraud in real time.

Paper Bitcoin is the greatest backhanded compliment in financial history. No debate. It screams: “This thing is too powerful to kill — so we’ll cage it in derivatives.”

How Long Can the Paper Game Last?

Not forever. Here’s the countdown:

PHASES:

Accumulation

Timeline: 2024-2026

Trigger: Institutions suppress price via shorts while stacking real BTC (MicroStrategy: 400k+ BTC and counting).

Redemption Pressure

Timeline: 2026-2028

Trigger: ETF outflows during a stock crash force in-kind redemptions. Custodians scramble — many IOUs go unfulfilled.

Custody Crisis

Timeline: 2028-2030

Trigger: One major “hack” or default (e.g., Coinbase insolvency) triggers proof-of-reserves panic. Paper BTC → $0. Real BTC → $1M+.

On-Chain Victory

Timeline: 2030+

Self-custody becomes default. ETFs delist or convert to full-reserve wrappers. Bitcoin fulfills its promise.

The math is brutal:

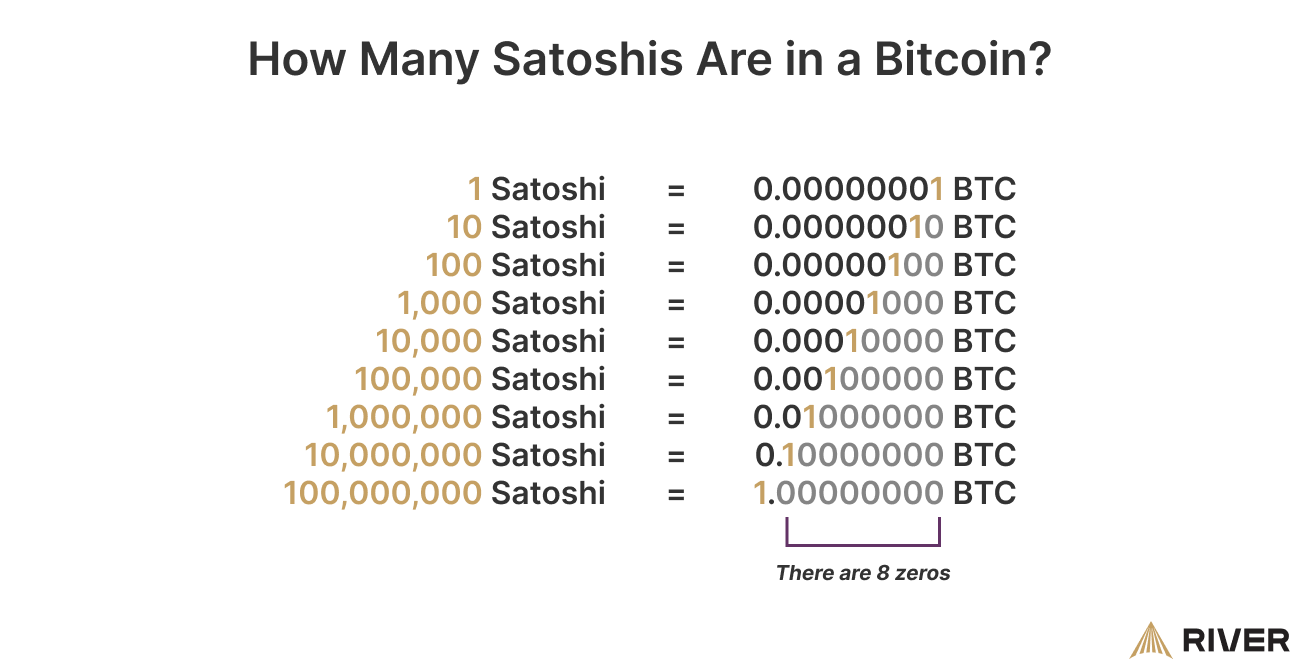

There are ~19.8M BTC mined.

ETFs + custodians claim exposure to >25M via rehypothecation.

That’s a 25%+ fractional reserve bubble — worse than pre-2008 banks. One black swan (regulatory audit, exchange hack, or mass redemption) and the paper house collapses. Inevitability.

Your Move: Don’t Get Left Holding the Bag

Withdraw from ETFs — Trade IBIT for actual BTC on a non-custodial exchange. (JUST MAKE SURE YOU ARE BUYING BITCOIN ON CHAIN AND THEN PUT IT IN COLD STORAGE!!! MY MESSAGE HAS BEEN THE SAME FOR ALMOST 10 YEARS NOW!!!!)

Verify custody — Use proof-of-reserves tools to check your exchange.

Self-custody — Hardware wallet + multisig. Not your keys, not your cheese.

Watch the premium — When spot BTC trades at a persistent premium to ETF NAV, the endgame is near….

Final Thought

“They didn’t kill Bitcoin. They franchised it.”

But franchises fail when the real product walks out the door…

The paper game can last years — maybe a decade tops.

But every fake BTC printed makes the real one more valuable…

Stack SATS 0.00%↑ accordingly!

(NOT FINANCIAL ADVICE, DO YOUR OWN RESEARCH!!!)

God-Willing, see you at the next letter.

Think Free & Stack Sats!

GRACE & PEACE